Finance Minister has introduced new Tax Regime for Tax payers in Union Budget FY 2020-2021 which was presented in parliament on 01st February, 2020.

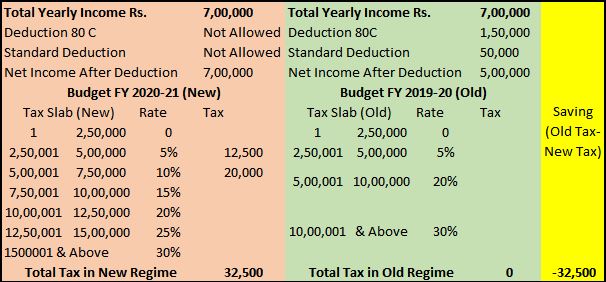

Before going further let us recall the old (FY 2019-2020) and new (FY 2020-2021) tax slab:

Moreover tax payers can choose to pay tax from old tax slab with deduction and exemption or from new tax slab without any exemption and deduction.

Dividends received shall be taxed in the hands of the recipients at their applicable tax rate or slab.

Levy of perquisite tax on salaried employees if the contribution on EPF, NPS, Superannuation together is higher than Rs 7.5 lakhs per year.

In this article we will compare total income in both i.e old and new tax slabs, and then we will check the viability of New Tax regime.

Notes:

- While doing any calculation we have not considered Cess / Surcharge / Education Cess.

- For calculation purpose savings under 80 C and standard deduction is taken into account.

- Red highlighted will show not viable and Green highlighted will show viable option.

- Yellow Highlighted shows savings i.e Tax in Old Regime minus Tax in New Regime.

Option B: Total Annual Income is Rs 7,50,000. Old Tax Slab is Viable

Option C: Total Annual Income is Rs 10,00,000. Old Tax Slab is Viable

Option D: Total Annual Income is Rs 12,50,000. New Tax Slab is Viable

Option E: Total Annual Income is Rs 15,00,000. New Tax Slab is Viable

Option F: Total Annual Income is Rs 18,00,000. New Tax Slab is Viable

Option G: Let us consider another example where Tax payer has done various investments in various ares and availing exemptions and deductions in various sections of Income Tax Act. In this example Old tax Regime is far better option then new Tax Regime.

Conclusion:

- Seeing above calculation it is pretty clear that Old tax regime is a viable option upto total income of Rs 10,00,000.

- New Tax Regime is a viable option above Rs 10,00,000

- New Tax Slab is only viable, if tax payer is not doing saving or availing any deduction or exemptions.

- Option G, shows that, if any one who is doing Investment and savings has to pay less tax in Old Regime.

- Any tax payer who is saving/ investing in EPF, PPF or any insurance then he cannot stop these investment because of new tax regime.

- Many tax payers avails home loan, in order to build asset and avail tax exemption, for them new tax regime is not viable.

Verdict: In my view, government has played with us, by introducing new tax slab and making the Income tax filing process more tedious. By introducing new Tax Regime government has given more money in the hands of individuals by which they will spend more and more money will be infused in the system. After introduction of new slab, tax payers (especially youngsters) will not be interested in any kind of saving or investment, which a individual does for future safety or security.

Choice is Yours.....

Sources: Various publications

Disclaimer: The information provided herein is based on publicly available information and other sources believed to be reliable, but involve uncertainties that could cause actual events to differ materially from those expressed or implied in such statements. The document is given for general and information purpose and is neither an investment advice nor an offer to sell nor a solicitation. While due care has been exercised while preparing this document, we do not warrant the completeness or accuracy of the information. We will not accept any liability arising from the use of this material. The recipient of this material should rely on their investigations and take their own professional advice.

Follow, Like, subscribe and share

"Your Trust, Our Financial Expertise."

Infyture, Investment For Your Future

Contact: +91-7990271953 // 8347871052

Website: http://infyture.wordpress.com

No comments:

Post a Comment

Please do not Enter any Spam Link in Comment Box