IPO Analysis : Easy Trip Planners Ltd

It got incorporated in 2008, Easy Trip Planners Ltd is the second largest

online travel agency in India in terms of gross revenue. The online

travel agency offers a range of travel products and services and

end-to-end travel solutions including airline tickets, rail tickets, bus

tickets, taxis, holiday packages, hotels, and other value-added

services i.e. travel insurance, visa processing, etc.

It offers a range of online traveling services through its website, android and iOS mobile application. The company follows B 2 B 2 C (business to business to customer), B 2 C (business to customer), and B 2 E (business to enterprise) distribution channels to offers its services.

They were ranked third among the Key Online Travel Agencies in India in terms of gross booking revenues and air tickets gross booking revenues in FY19.

They have been consistently profitable since incorporation and according to the CRISIL Report they were the only profitable online travel agency among the Key Online Travel Agencies in India in FY19. Their market share in the Indian online travel agency industry in terms of gross booking revenues and gross booking revenues for air ticketing segment was 3.8%, and 4.5% to 5%, respectively, in FY19.

As of November 30, 2019, they provided their customers with access to more than 400 international and domestic airlines, more than 1,096,400 hotels in India and in international jurisdictions, almost all railway stations in India as well as bus tickets to and cab rentals for major cities in India. They provide customers with the option of no-convenience fee, such that customers are not required to pay any service fee in instances where there is no alternate discount or promotion coupon being availed.

Competitive strengths:

- One of the leading online travel agencies in India.

- Strong brand name and distribution network.

- In-house advanced technology infrastructure.

- Consistent financial track record and operational performance

Financial Detail of The Compnay (In Rs. Cr)

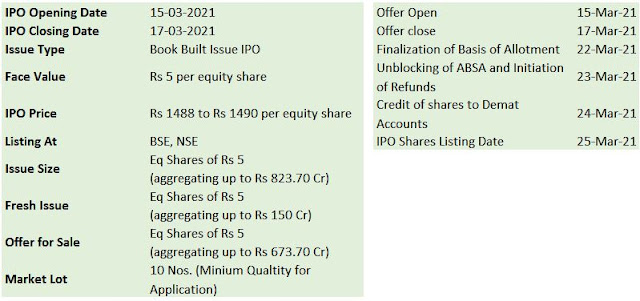

Important Dates and Facts to Remember:

Verdict:

One can apply for this IPO solely for listing gain only.

Sources:

Various publications

Disclaimer: The

information provided herein is based on publicly available information and

other sources believed to be reliable, but involve uncertainties that could

cause actual events to differ materially from those expressed or implied in

such statements. The document is given for general and information purpose and

is neither an investment advice nor an offer to sell nor a solicitation. While

due care has been exercised while preparing this document, we do not warrant

the completeness or accuracy of the information. We will not accept any

liability arising from the use of this material. The recipient of this material

should rely on their investigations and take their own professional advice.

Follow, Like, subscribe

and share

"Your Trust, Our

Financial Expertise."

Infyture, Investment For Your Future

Email: infyture@gmail.com

Website: http://infyture.wordpress.com

Facebook Page: https://www.facebook.com/infyture4future/

Youtube:https://www.youtube.com/channel/UCjOxVGTKQiK5O0mdcuMBCdw?view_as=subscriber

Blogger: https://infyture.blogspot.com/

WhatsApp: https://wa.me/message/SXE3AQCBR3O4B1

Telegram:

https://t.me/infyture

Goal Based Planning || Equity

Tip || Demat Account || Mutual Fund Investment || Life Insurance || General

& Health Insurance || PMS & mini PMS || Retirement Planning || NPS

Enrollment