Review of RBI Monetory Policy 09-10-2020

The Monetary Policy Committee (MPC), in its first meeting with three new external members, today unanimously voted in favour of keeping the policy Repo Rate unchanged at 4.0%. It also voted in favour of maintaining an accommodative stance as long as it is necessary - at least during the current financial year and into the next financial year - to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. The Reverse Repo Rate was also kept unchanged at 3.35%.

RBI also announced number of liquidity and regulatory measures to “provide impetus towards reviving the economy”

Increased the size of each OMO auction to INR 20,000 crore from INR 10,000 crore currently. This should help improve the liquidity and ease yields.

To conduct OMOs in SDLs to improve liquidity and facilitate efficient pricing in FY21. This will be conducted for a basket of SDLs comprising securities issued by States. While more details are awaited on the modalities of the same, till now, RBI has conducted OMOs in Gsec only and this step should help soften the yields and spreads for SDLs.

On tap TLTROs upto INR 1 lakh crore with tenors of upto three years (floating rate linked to the policy rate) which can be availed by end-March 2021. The fund availed under this scheme should be utilised for investing in NCDs, corporate bonds, commercial papers or extending loans and advances to specific sectors. This should help improve the credit flow to specific sectors.

Extend the dispensation of enhanced HTM limits of 22% (from 19.5%, done on September 1, 2020) of NDTL by one year to 31 March 2022 for SLR securities bought between September 1, 2020 to March 31, 2021. Further, HTM limit would be restored from 22% to 19.5% in a phase wise manner starting June 2022.

Rationalised the risk weights for individual housing loans and linked it to Loan to Value ratios (LTV) only instead of current differential risk weights determined based on size as well as LTV ratio. This should reduce the capital adequacy requirement of lending institutions and incentivise lending to real estate sectors.

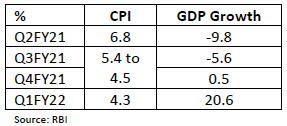

After 8 months, RBI provided its CPI estimates for next 12 months in which it expects inflation to soften from Q3FY21 onwards and reach near targeted 4% by Q1FY22. RBI noted that CPI has remained at elevated level, despite muted aggregate demand, due to price rise in food, fuel and core components on account of supply side disruptions, cost push pressure, higher margins and taxes. However, it expects that it should moderate driven by easing restrictions, recovery in supply side, high food grain and horticulture production, range bound crude oil prices, etc. Hence, it considers current elevated inflation as “transient” in nature and recognises the need to focus on reviving growth.

While RBI expects GDP to contract by 9.5% in FY21, it expects the economic conditions to improve sequentially from the lows seen in Q1FY21 (refer table for detailed growth expectations). However, it expects the recovery to be uneven with sector specific factors playing a dominant role in pace of revival. Sectors like agriculture, FMCG, two wheeler, passenger vehicles, tractors, power generation, pharma, etc. are likely to better off. However, revival in urban demand, contact intensive services, private investments etc. is likely to be at subdued pace and activity in these sectors could take some time to reach to pre-covid level.

Conclusion and Outlook

RBI’s decision of keeping the policy repo rate unchanged was largely in line with consensus expectations. However, the additional measures announced by RBI to improve liquidity, credit flows to specific sectors and conducting OMOs for SDLs came in as a positive surprise. In his statement, RBI also mentioned that it is ready to conduct OMOs to assuage pressure of increase in supply of SLR securities due to likely increase in fiscal deficit.

The speech by RBI Governor and policy statement was perceived dovish by market participants and resulted in fall in Gsec yields between 5 to 15 bps across the curve. Announcement of on tap TLTRO bodes well for corporate bonds and yields of corporate bonds rallied by 10 to 25 bps.

Over the past few months, apart from reduction in policy rates, RBI has consistently demonstrated its intent to revive growth and has been undertaking conventional and unconventional measures to improve liquidity and maintain easy financing conditions. In addition to steps announced today, it has conducted OMOs, operation TWIST, LTROs, TLTROs, increased HTM limits, etc. to demonstrate its commitment. Today’s announced measures and speech by RBI Governor highlights that consideration towards aiding economic recovery weighs significantly on the monetary policy decisions for the time being. Further, RBI governor in his speech mentioned that “RBI stands ready to undertake further measures as necessary to assure market participants of access to liquidity and easy financing conditions”, indicating that RBI will not shy from using conventional and unconventional tools to smoothen yields and foster orderly market conditions.

Apart from above, weak oil prices, positive outlook on Balance of Payment, benign inflation outlook, lower global rates and easing liquidity by major central banks bodes well for yields in India and there is some room for yields to decline, in our opinion.

However, high near term inflation, possibility of large supply from Central as well as State governments in Q4FY21, sharp reversal in oil prices, announcement of fiscal stimulus, etc. are key risks to our view. In view of the above, yields at the longer end of the curve are likely to trade within a range in the foreseeable future. Considering the aforesaid factors, we continue to recommend investment in short to medium duration debt funds.

While credit environment still warrants caution, RBI measures have helped corporate bonds, especially AAA rated bonds, spreads to ease significantly over the past few months. However, we believe that there are still attractive investments opportunities in select pockets in non-AAA rated bonds, as their spreads relative to AAA rated bonds continue to remain at elevated level compared to historical average. Hence, allocation to credit oriented schemes or funds with some non-AAA exposure can be maintained / increased, to a certain extent, in line with individual risk appetite.

Some terms to Remember:

Sources:

Various publications

Disclaimer: The

information provided herein is based on publicly available information and

other sources believed to be reliable, but involve uncertainties that could

cause actual events to differ materially from those expressed or implied in

such statements. The document is given for general and information purpose and

is neither an investment advice nor an offer to sell nor a solicitation. While

due care has been exercised while preparing this document, we do not warrant

the completeness or accuracy of the information. We will not accept any

liability arising from the use of this material. The recipient of this material

should rely on their investigations and take their own professional advice.

Follow, Like, subscribe

and share

"Your Trust, Our

Financial Expertise."

Infyture, Investment For Your Future

Email: infyture@gmail.com

Website: http://infyture.wordpress.com

Facebook Page: https://www.facebook.com/infyture4future/

Youtube:https://www.youtube.com/channel/UCjOxVGTKQiK5O0mdcuMBCdw?view_as=subscriber

Blogger: https://infyture.blogspot.com/

Goal Based Planning || Equity

Tip || Demat Account || Mutual Fund Investment || Life Insurance || General

& Health Insurance || PMS & mini PMS || Retirement Planning || NPS

Enrollment

No comments:

Post a Comment

Please do not Enter any Spam Link in Comment Box