What are Economic Indicators and their Importance

Economic

indicators are key stats about the economy that can help you better

understand where the economy is headed. These indicators can help

investors decide when to buy or sell investments. For example, if the

stock market is at its peak, you may want to sell. If the market is low

and on the rise, you may want to buy. Economic indicators can help you

understand the flow of market, as well as other important

financial factors.

Types of Economic Indicators

Leading indicators:

Leading

indicators signal future changes. That means, they usually change

before the economy itself changes. This makes them extremely useful for

short term predictions of economic developments. An example of a leading

indicator is the stock market. Stock market returns usually start to

decline, before the economy as a whole falls into a recession and vice

versa.

Lagging Indicators:

Lagging indicators usually change

after the economy as a whole changes. For that reason, they cannot

directly be used to predict economic changes. They are more useful to

confirm specific patterns (e.g. economic cycles) and make further

predictions from there. Arguably the most popular example of a lagging

indicator is unemployment. Unemployment usually starts to increase a few

quarters after the economy has started to recover from a recession.

Coincident Indicators:

Coincident

indicators occur at about the same time as the changes they signal.

Therefore, they can provide valuable information about the current state

of the economy. An example of a coincident indicator is personal

income. If the economy is strong and business is going well, personal

income rates will increase at about the same time.

Attributes of Economic Indicators:

It may possess one of the three following attributes:

Pro cyclical:

It

is an indicator that moves in a direction similar to the economy. For

example, GDP is pro cyclical because it increases if the economy is

performing well. If the economy is not doing well (i.e., recession), GDP

decreases.

Counter cyclical:

It is an indicator that moves

in the opposite direction of the economy. For example, the unemployment

rate declines if the economy is thriving.

A cyclical:

It is an indicator that bears no relationship to the economy at all.

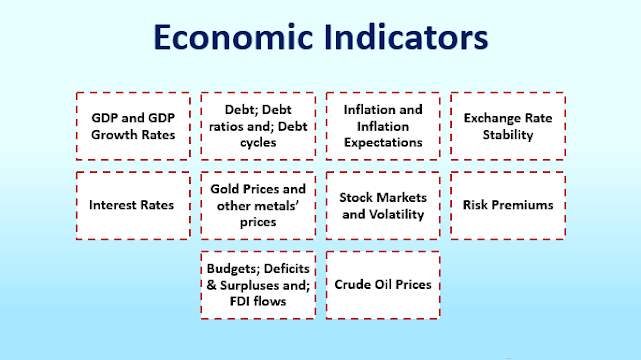

Few Important Economic Indicators:

Gross Domestic Product (GDP)

GDP

is a lagging indicator. It is one of the first indicators used to gauge

the health of an economy. It represents economic production and growth,

or the size of the economy.

An increase in GDP indicates that

businesses are making more money. It also suggests an increase in the

standard of living for people in that country. If GDP decreases, then it

suggests the reverse.

Balance of Trade

Balance of

trade is a lagging indicator. It’s the net difference between a

country’s value of imports and exports, and shows whether there is a

trade surplus or a trade deficit. A trade surplus is generally

desirable, and shows that there is more money coming into the country

than leaving. A trade deficit shows that there is more money leaving the

country than coming in. Trade deficits can lead to significant domestic

debt. In the long term, a trade deficit can result in a devaluation of

the local currency, since it leads to significant debt. The increase in

debt will reduce the credibility of the local currency. It could also

lead to a major financial burden for future generations, since they will

be forced to pay off that debt.

Inflation

Inflation

measures the cost of goods and services. Inflation has a key effect on

economies and markets. For economies, high inflation discourages savings

and investment, leads to higher interest rates, and ultimately limits

growth. In markets, higher inflation may initially lead to asset price

increases, but ultimately investors will pay lower multiples and real

wealth will decline. The key reports to focus on are the Producer Price

Index (PPI) and Consumer Price Index (CPI). Use a moving average of the

year-over-year change and watch for results that are negative (signaling

deflation) or over four percent.

Housing

In a land of

increasing house prices, banks lend and the economy booms. However, the

housing game has changed. We have lived through the housing collapse, we

expect banks to become more prudent for many years. Weakness in housing

will lead to a drop in lending and economic contraction. Many reports

track housing. New home sales and existing home sales are the most

popular. However, I prefer to look at housing starts and building

permits. Permits are a leading indicator and offer an assessment of

housing demand. When permits are rising, house prices should appreciate

as well.

Spending

We live in a consumption-based society.

As consumers increase their expenditures, the economy grows. While many

surveys attempt to capture people’s feelings about the state of the

economy, behavior is what counts. Look to the monthly retail sales

report for an indication of actual consumer activity.

Consumer Price Index (CPI)

CPI is a lagging indicator, and the U.S. relies on it heavily as one of the best indicators of inflation. This is because changes in inflation can spur the Federal Reserve to make changes to its monetary policy.

CPI measures changes in prices paid for goods and services by urban consumers for a specified month. It’s essentially a measure of the cost of living changes. It offers a gauge of inflation as it relates to purchasing those goods and services.

CPI takes a sampling of several hundred goods and services across 200 categories. CPI does not include Social Security taxes, income, or investments in stocks, bonds or life insurance. However, it does include all sales taxes associated with the purchase of those goods.

Producer Price Index (PPI)

PPI is a coincident indicator that tracks price changes in almost all goods-producing sectors, including mining, manufacturing, agriculture, forestry and fishing. PPI also tracks price changes for an increasing portion of the non-goods-producing sectors of the economy. The report measures prices for finished goods, intermediate goods and crude goods. Prices from thousands of establishments are tracked each month and are recorded on the U.S. Bureau of Labor Statistics website.

PPI is important because it’s the first inflation measure available in the month. It captures price movements on a wholesale level, before price changes show up on the retail level.

Interest Rates

Interest rates are a lagging indicator of economic growth. They are based around the federal funds rate, which is determined by the Federal Open Market Committee (FOMC). When the federal funds rate increases, interest rates increase. The federal funds rate increases or decreases as a result of economic and market events.

When interest rates increase, borrowers are more reluctant to take out loans. This discourages consumers from taking on debt and businesses from expanding, and as a result, GDP growth may become stagnant.

If interest rates are too low, that can lead to an increased demand for money and raise the likelihood of inflation. Raising inflation can distort the economy and the value of its currency. Current interest rates are indicative of the economy’s current condition, and can also suggest where the economy might be headed.

Currency Strength

Currency strength is a lagging indicator. When a country has a strong currency, its purchasing and selling power with other nations is increased. A country with a strong currency can import products at a cheaper rate and sell its products overseas at higher foreign prices. However, when a country has a weaker currency, it can draw in more tourists and encourage other countries to buy its goods since they are cheaper.

Manufacturing Activity

Manufacturing is a leading economic indicator. Durable goods orders are an indicator of manufacturing activity. The term “durable goods” refers to consumer products that usually aren’t replaced for at least a few years, such as refrigerators and cars. Near the end of each month, the Department of Commerce Census Bureau publishes its report on durable goods.

Durable goods orders are a measure of new orders manufacturers receive for those types of goods. An increase in durable goods orders is generally taken as a sign of economic health, while a decline might indicate trouble in the economy. Increases and decreases in durable goods orders may also be associated with increases and decreases in stock indices, respectively.

Income and Wages

Income and wages are a lagging indicator. When the economy is operating properly, earnings should increase to keep up with the average cost of living. However, when incomes decline relative to the average cost of living, it is a sign that employers are either laying off workers, cutting pay rates or reducing employee hours. Declining incomes can also indicate an environment where investments are not performing as well.

Incomes are broken down by different demographics, like age, gender, level of education and ethnicity. These demographics can give insight into how wages change for certain groups. A trend that may affect what seems to be only one smaller group may actually suggest an income problem for the entire country, rather than just the group it initially affects.

There’s no golden rule in investing, but considering these economic indicators one can help themself to make informed investment decisions. The Federal Reserve releases a report known as "the Beige Book" eight times per year. The Beige Book outlines the nation’s economic conditions and it can be a useful resource for investors, economists and analysts. Economic indicators are important to take into account before making any investment decisions. With a little research, you’ll be able to maximize

Disclaimer: The

information provided herein is based on publicly available information and

other sources believed to be reliable, but involve uncertainties that could

cause actual events to differ materially from those expressed or implied in

such statements. The document is given for general and information purpose and

is neither an investment advice nor an offer to sell nor a solicitation. While

due care has been exercised while preparing this document, we do not warrant

the completeness or accuracy of the information. We will not accept any

liability arising from the use of this material. The recipient of this material

should rely on their investigations and take their own professional advice.

Follow, Like, subscribe

and share

"Your Trust, Our Financial Expertise."

Infyture, Investment For Your Future

Email: infyture@gmail.com

Website: http://infyture.wordpress.com

Facebook Page: https://www.facebook.com/infyture4future/

Youtube:https://www.youtube.com/channel/UCjOxVGTKQiK5O0mdcuMBCdw?view_as=subscriber

Blogger: https://infyture.blogspot.com/

WhatsApp: https://wa.me/message/SXE3AQCBR3O4B1

Telegram:

https://t.me/infyture

Goal Based Planning || Equity Tip || Demat Account || Mutual Fund Investment || Life Insurance || General & Health Insurance || PMS & mini PMS || Retirement Planning || NPS Enrollment

Very good article

ReplyDelete