On Economic Growth: The economic recovery is progressing well supported by receding cases, easing restrictions and improvement in pace of vaccination. The revival has been broad based with improvement in PMIs, steady growth in industrial production, forecast of strong food grain production, robust non-oil non-gold exports.

Further, high frequency indicators like cement production, railway freight traffic, e-way bills, power generation, etc. also points at fast pace normalization. However, select segments like contact intensive services, aviation etc. continue to remain under pressure. While Q1FY22 GDP growth came in slightly lower than estimated, RBI has retained the full year growth forecast and has revised up its growth estimate for Q2FY22 and Q3FY22. However, RBI continues to emphasis the need to nurture the recovery given the relatively low capacity utilization, uncertain external sector, high commodity prices and impact of monetary policy normalization in advanced economies.

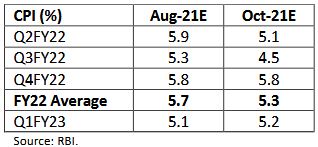

On Inflation: The average inflation for July and August 2021 has been considerably lower than RBI’s forecast. This was mainly driven by soft momentum in vegetable prices and favourable base effect. However, fuel prices inched up further on back of rise in international crude prices and core inflation (CPI ex food & fuel) continues to remain sticky and at elevated level.

In view of lower food inflation, expectation of record food grain production, supply side measures by government on edible oil and pulses, lower pass through of high input prices, etc. RBI has revised down its CPI forecast by 80 bps for Q2FY22 and Q2FY23. Consequently, the full year target has been revised down by 40 bps.

Conclusion and Outlook

The status quo of monetary policy and increase in VRRR quantum was largely in line with consensus expectations and there was no major surprise in the policy. However, no new G-SAP announcement for

Q3FY22 was perceived a little negative by the market and yields at the longer end inched up slightly. However, Governor in his statement stressed that RBI retains the flexibility of conducting G-SAP and using other liquidity tools including operation TWIST and OMOs as and when deemed necessary.

Governor reemphasized that increase in quantum of VRRR should not be perceived as reversal from accommodative stance. RBI expects that the inter bank liquidity (excluding the VRRR) is likely to remain in the range of INR 2 to 3 lakh crore by early December 2021 i.e. ~2% of NDTL from ~4.5% currently.

Going forward, the fixed income market can face some headwinds as factors like elevated crude prices, resilient retail inflation, increase in inflation expectations, high SLR holding of banks, good recovery

momentum, etc. may adversely impact the yields. Further, hawkish commentary by US FOMC, rise in international commodity prices, etc. can put upward pressure on Gsec yield too.

However, despite the fixed income environment being not so favourable over the past few months, the rise in yields has been rather modest till now, primarily driven by continued RBI intervention through

deployment of conventional and unconventional tools. Over the past one and half year, RBI has extensively used policy tools like LTROs, TLTROs, operation TWIST, G-SAP, etc. to achieve “orderly

evolution” of yield curve. Further, the buoyant revenue collections have reduced the risk of fiscal slippage. Also, borrowing for compensation cess has been subsumed within the Government borrowing program and there is likely to be no increase from budgeted borrowing program.

In view of the above, we expect yields to trade within a range with an upward bias. However, given the increase in VRRR quantum and possibility of reverse repo rate hike in coming months, we expect the yields at shorter end to rise faster. In view of the aforesaid and relatively steep yield curve, we continue to recommend investments into short to medium duration debt funds, possibly, in a staggered manner

in line with individual risk appetite.

Sources:

Various publications

Disclaimer: The

information provided herein is based on publicly available information and

other sources believed to be reliable, but involve uncertainties that could

cause actual events to differ materially from those expressed or implied in

such statements. The document is given for general and information purpose and

is neither an investment advice nor an offer to sell nor a solicitation. While

due care has been exercised while preparing this document, we do not warrant

the completeness or accuracy of the information. We will not accept any

liability arising from the use of this material. The recipient of this material

should rely on their investigations and take their own professional advice.

Follow, Like, subscribe

and share

"Your Trust, Our

Financial Expertise."

Infyture, Investment For Your Future

Email: infyture@gmail.com

Website: http://infyture.wordpress.com

Facebook Page: https://www.facebook.com/infyture4future/

Youtube:https://www.youtube.com/channel/UCjOxVGTKQiK5O0mdcuMBCdw?view_as=subscriber

Blogger: https://infyture.blogspot.com/

WhatsApp: https://wa.me/message/SXE3AQCBR3O4B1

Telegram:

https://t.me/infyture

Goal Based Planning || Equity

Tip || Demat Account || Mutual Fund Investment || Life Insurance || General

& Health Insurance || PMS & mini PMS || Retirement Planning || NPS

Enrollment

No comments:

Post a Comment

Please do not Enter any Spam Link in Comment Box