Market Flash on 16th December 2019.

Benchmark indices have turned flat after making a higher opening. Earlier, the Sensex and Bank Nifty had clocked fresh life-time highs, buoyed by the progress in the US-China trade talks and on the Brexit front. The S&P BSE Sensex clocked the life-time high of 41,185 in the opening deals.

Benchmark indices have turned flat after making a higher opening. Earlier, the Sensex and Bank Nifty had clocked fresh life-time highs, buoyed by the progress in the US-China trade talks and on the Brexit front. The S&P BSE Sensex clocked the life-time high of 41,185 in the opening deals.

At 10:25 AM, the S&P BSE Sensex was trading at 41,002, down 7 points or 0.02%. Market breadth are positive and out of a total of 1,817 shares traded on the Bombay Stock Exchange, 908 advanced while 777 declined and 132 remained unchanged. The Nifty50 was down 7 points or 0.02% at 12,081. 10-year Indian G-Sec yields were trading at 6.782 in morning against the previous close of 6.782.

The Week That Was

Markets ended with major gains during the week on positive global cues. Optimism over US-China deal and hopes of a swift Brexit after thumping election win by Britain's Conservative Party boosted sentiment.

Both, Sensex and Nifty ended above their psychological 41,000-mark and 12,000-mark, respectively. In the week ended on Friday, December 13, 2019, the Sensex rose 564.56 points or 1.40% to settle at 41,009.71. The Nifty 50 index advanced 165.20 points or 1.39% to settle at 12,086.70.

Global Markets

Asian shares moved higher today as investors welcomed a trade agreement between Beijing and Washington over the weekend, but enthusiasm was capped by lingering scepticism about the deal and ongoing relations between China and the United States.

US Trade Representative Robert Lighthizer on Sunday said a deal was “totally done”, not withstanding some needed revisions, and would nearly double U.S. exports to China over the next two years.

That helped push the MSCI’s broadest index of Asia-Pacific shares outside Japan, which had touched its highest level since April 24 on Friday, up 0.27%. Australia’s S&P/ASX 200 led the way as it jumped 1.24%, while shares in Taiwan and South Korea added about 0.1%.

But Chinese investors had a more tepid reaction, pulling the benchmark Shanghai Composite index down 0.16% as investors took profits following a 1.8% gain on Friday. Japan’s Nikkei 225 also succumbed to profit-taking, easing 0.14% after surging 2.55% to a 14-month closing high on Friday.

Indian Rupee

Indian rupee was trading little changed against the US dollar on Monday amid mixed cues from Asian currencies. At 10.10 am, rupee was trading at 70.80 a dollar, up 0.01% from Friday's close of 70.82.

Crude Oil

Oil prices fell but remained near three-month highs on Monday after the United States and China agreed to an initial trade deal, a move market participants said could stoke oil demand and boost trade flows.

Brent crude oil futures fell 23 cents, or 0.4% to $64.99 a barrel, after closing at a near three-month high on Friday. West Texas Intermediate crude was down 23 cents or 0.4% to $59.84 a barrel.

Week Ahead

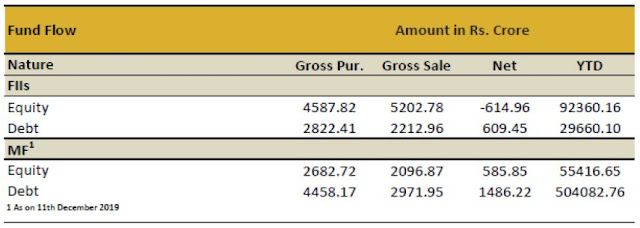

Global cues, macroeconomic data, movement of rupee against the dollar, Brent crude oil price movement and investments by foreign portfolio investors (FPI) and domestic institutional investors (DII) will be watched in the week ahead.

On the macro front, the WPI Inflation (YoY) for November 2019 will be unveiled today. The Reserve Bank of India (RBI) will on Thursday, December 19, 2019 announce the minutes of its monetary policy review meeting held on 5 December 2019.

The 38th GST Council meeting is reportedly scheduled on December 18, 2019. The goods and services tax (GST) rates and slabs may be raised during the GST Council meeting this week.

Prime Minister Narendra Modi will reportedly address the annual general meeting of the Associated Chambers of Commerce and Industry of India (Assocham) on 20 December 2019.

On the global front, China's industrial production data for November 2019 will be unveiled today. The Bank of Japan (BoJ) will announce its interest rate decision on Thursday. The US GDP Growth Rate QoQ final estimate Q3 will be announced on Friday.

The US Market Manufacturing PMI for December 2019 will be announced today. In Europe, the Euro Area Markit Manufacturing PMI for December 2019 will also be announced today.

Sources:

Various publications

Disclaimer: The

information provided herein is based on publicly available information and

other sources believed to be reliable, but involve uncertainties that could

cause actual events to differ materially from those expressed or implied in

such statements. The document is given for general and information purpose and

is neither an investment advice nor an offer to sell nor a solicitation. While

due care has been exercised while preparing this document, we do not warrant

the completeness or accuracy of the information. We will not accept any

liability arising from the use of this material. The recipient of this material

should rely on their investigations and take their own professional advice.

Follow, Like, subscribe and

share

"Your Trust, Our

Financial Expertise."

Infyture, Investment For Your Future

infyture.blogspot.com

Financial Planning ||

Equity Tip || Demat Account || Mutual Fund Investment || Life Insurance ||

General & Health Insurance || PMS & mini PMS || Retirement Planning

No comments:

Post a Comment

Please do not Enter any Spam Link in Comment Box